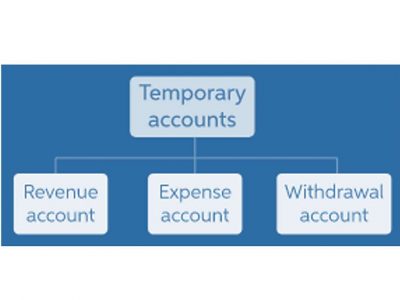

These accounts will be temporary, meaning that they will begin with a zero balance and end with a zero balance. These temporary accounts, therefore, will not appear on the balance sheet. Their net effect will be transferred into Retained Earnings in what is called a closing entry. Net income is calculated by deducting a company’s expenses, and depreciation is one of those expenses.

Income Recognition Methods

- This can occur when a company intentionally uses an income recognition method that results in a more favorable financial picture.

- Cash flow is the net amount of cash and cash equivalents being transacted in and out of a company in a given period.

- Net income is calculated by deducting a company’s expenses, and depreciation is one of those expenses.

- The process of looking for the expenses corresponding to recognized revenue is called matching.

- An increasing trend of accounts receivable could indicate that a company might be lowering its credit issuance restrictions to generate more sales.

Still, the company could also be involved in channel stuffing which would make its revenues seem inflated. For example, if a company uses the accrual method to recognize revenue, it will recognize revenue from a sale even if the cash has not yet been received. Under the accrual method, revenue is recognized when it is earned, regardless of when cash is received. This method is used by most businesses because it provides a more accurate picture of the company’s financial performance.

- If a company has positive cash flow, the company’s liquid assets are increasing.

- Net income recognition always increases – Net income recognition, the cornerstone of accounting practices, has always been on an upward trajectory.

- The concept of net income recognition revolves around the timing of revenue recognition, which profoundly influences the reported net income.

- Depreciation accounts for declines in the value of the asset and spreads the expense of it over the years of the useful life of that asset.

- Under the accrual method, revenue is recognized when it is earned, regardless of when cash is received.

- If a company has positive cash flow, it means the company’s liquid assets are increasing.

Question: Net income recognition always increases:liabilities.net liabilities.assets.net assets.

Matching is a process of looking for assets consumed or liabilities incurred in the generation of revenues. A lot of the identification of https://x.com/BooksTimeInc expenses comes from looking at assets to see if they have been consumed or liabilities to see if they have been increased. Net income is calculated by subtracting the costs of doing business, including expenses, taxes, depreciation, and interest on debt from total revenue.

What Are Negative vs. Positive Cash Flows?

However, since depreciation is an accounting measure, it is not an outlay of cash. https://www.bookstime.com/ As a result, depreciation expense is added back into the cash flow statement when calculating the cash flow of a company. If a company uses the cash basis method to recognize revenue, it will not recognize revenue from a sale until the cash has been received. If revenue is recognized early, it will increase net income in the current period. If revenue is recognized late, it will decrease net income in the current period. Net income recognition always increases – Net income recognition, the cornerstone of accounting practices, has always been on an upward trajectory.

Expenses are things that decrease income, the costs incurred in the generation of revenues. Recognition is the act of formally entering an item into the accounting records. We must designate a convention for revenue recognition so that there is consistency in accounting metrics across different companies and industries.

- Net income is calculated by subtracting the costs of doing business, including expenses, taxes, depreciation, and interest on debt from total revenue.

- A cash flow to earnings that is consistently below 1 might be a signal of heavy use of accrual accounting.

- Their net effect will be transferred into Retained Earnings in what is called a closing entry.

- A negative net income means a company has a loss, and not a profit, over a given accounting period.

- Cash flow is reported on the cash flow statement, which shows where cash is being received and how cash is being spent.

Pay Attention to Capitalization Policies and Deferred Costs

- While a company may have positive sales, its expenses and other costs will have exceeded the amount of money taken in as revenue.

- Yes, there are times when a company can have positive cash flow while reporting negative net income.

- If a company uses the cash basis method to recognize revenue, it will not recognize revenue from a sale until the cash has been received.

- A company can still post a loss in its daily operations but have cash available or cash inflows due to various circumstances.

- Ethical considerations require transparent and accurate income recognition practices.

We begin by defining pivotal concepts such as income, revenue, and expenses. Suppression of expenses is the second most frequent method of financial report manipulation. Certain net income recognition always increases: expenses such as rent, insurance, and building costs are called period expenses .

Temporary Accounts

Depreciation helps companies avoid taking a huge deduction in the year the asset is purchased, allowing companies to earn revenue from the asset. Looking at the company’s filings, net income is carried over from the income statement and is the starting point for calculating cash flow. From the net income amount, cash transactions for the period are either added or subtracted. A cash flow to earnings that is consistently below 1 might be a signal of heavy use of accrual accounting.

Commenti recenti